Ahmedabad: Fifteen years ago, Ahmedabad-based businessman Darshan Patel was keen to enter the booming “look good, smell good” industry. But it didn’t pass his own smell test. The deodorant market was already awash in global brands. And Patel had a rule: “If consumers can name seven brands in a category, I don’t enter it.”

He went in anyway. And so was born Fogg, a brand that changed how India used deodorants.

One of the reasons Patel took the plunge was that the deo market was growing at “20 to 30 per cent annually”, but he was also looking for his own second innings at the age of 48, four years after retiring from his family business, Paras Pharmaceuticals.

“My family wasn’t in favour. I asked for 10 years to do passionate work, and Fogg was the outcome,” 62-year-old Patel said at his office in Ahmedabad’s Bodakdev, where shelves brim with dozens of big and small Fogg containers and framed snapshots of his wife and two children sit on his desk.

In his gravelly baritone, he delivered his Amitabh Bachchan-in-Mohabbatein-style philosophy: ‘I have a mantra—prayatna, prarthna, pratiksha, parivartan (effort, faith, patience, and change). I give every product 1,000 days to succeed or fail.”

And succeed it did. Within three years of its 2011 launch under the umbrella of Patel’s Vini Cosmetics, Fogg grabbed 10 per cent of the market.

Patel is the ‘Dronacharya’ of the fragrance industry, said competitor Saurabh Gupta, CEO of Denver Deodorants. But he is publicity shy and rarely gives media interviews. When he does open up, however, he is unfiltered and blunt.

For Patel, the gold standard for deodorant culture is Brazil—the world’s largest consumer.

“People there bathe three times a day and apply deodorant after each shower,” he said. India’s deodorant market is still growing and has yet to reach that level, but it holds significant potential, even if it will take some time to fully mature.”

The deodorant market is one of the fastest-growing sectors. It’s an overheated industry appealing to bottom-of-the-pyramid consumers in sweaty Indian cities and towns. From Shah Rukh Khan to Katrina Kaif to Saif Ali Khan, deodorant advertising has attracted the big names—not unlike the pull of pan masala brands. With Fogg, deodorants started doing what perfumes couldn’t in India—turning fragrance into a daily essential. Now, they’re about staying fresh through packed trains, office marathons, and gym sessions, as well as attracting women. They’re practical, pocket-friendly, and multi-purpose—used even for freshening up a dank cupboard. The sector has taken off in the past two decades, becoming a key advertiser in IPL, the World Cup, and big-ticket primetime shows such as Bigg Boss, and Indian Idol.

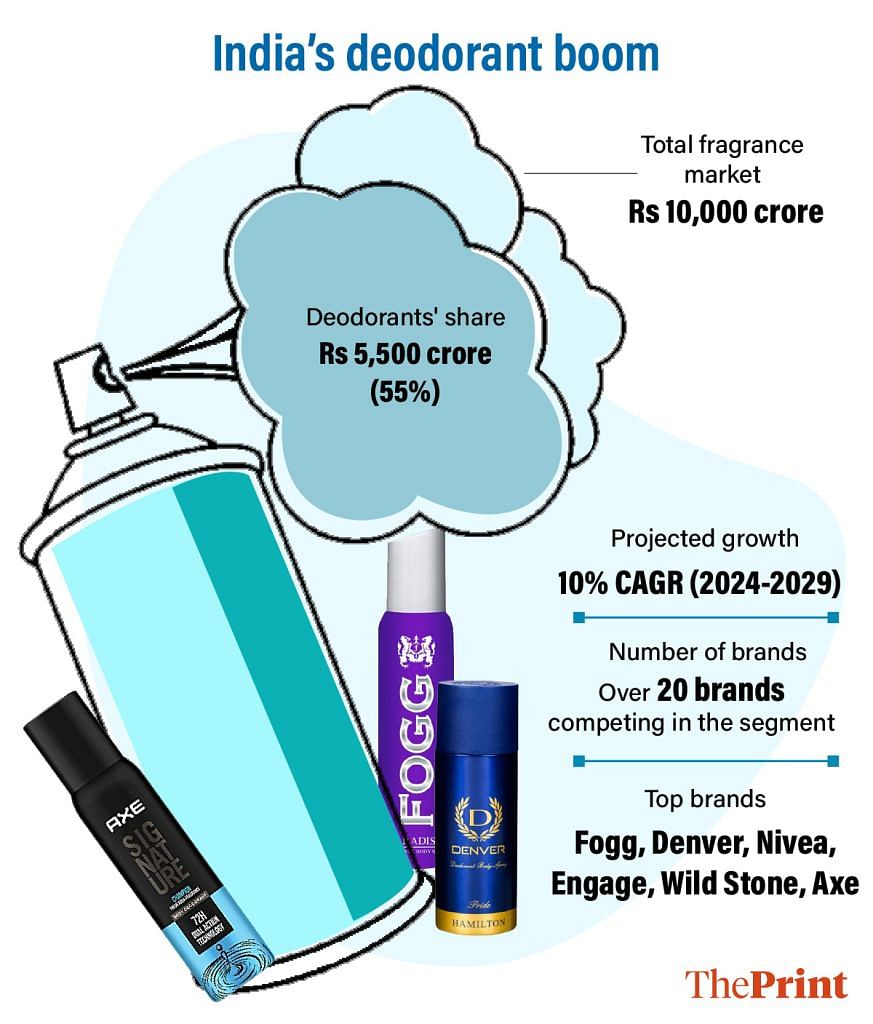

Deodorants were once the underdog in India’s fragrance market, but today they account for Rs 5,500 crore of the Rs 10,000 crore sector. Industry estimates project the sector will expand at a 10 per cent CAGR between 2024 and 2029.

Whenever an ad with a ‘chick magnet’ theme aired, someone had to awkwardly leave the room. It gets uncomfortable for a brother-sister, or father-daughter to watch these ads together as they pop up in middle of any show

-Darshan Patel

There are around 20 brands in the game, and Fogg leads with a 20 per cent market share.

Although Patel had already built household brands like Moov, Krack, Itch Guard, Dermicool, D’Cold, and Livon under Paras Pharmaceuticals, this was his first foray into fragrance. His biggest teacher was on-the-ground market research. He quickly discovered two things—frustration with deodorants that ran out in a few sprays and disillusionment with brands promising love at first sniff.

That led Patel to a two-pronged strategy: create a longer-lasting ‘no gas perfume spray’ and reposition deodorants not as “chick magnets” but as practical, everyday grooming products—with Indian sanskars baked in.

“Instead of doing ‘me too’ and following trends to be successful, it’s better to die doing something different,” Patel said.

Also Read: These chefs are done taking orders. They’re turning entrepreneurs

A sanskari deo

When Fogg first hit the market in 2011, its ads were all about the gas-free product. In one, the setting was a men’s gym and the tagline was “Kitna body pe lagaya, kitna gas pe gavaya?”—how much did you use on your body, and how much did you waste on gas? In another, a woman grumbled about “perfume wale gas cylinders” before extolling Fogg’s “perfume liquid”.

At the time, this was a rare approach. While most deodorant brands were still selling seduction, Fogg’s strategy was based on Indian sanskars and “800 sprays” per can.

“Whenever an ad with a ‘chick magnet’ theme aired, someone had to awkwardly leave the room. It gets uncomfortable for a brother-sister, or father-daughter to watch these ads together as they pop up in middle of any show. So, I wanted Fogg to feel like a friend—a homegrown brand that resonates with Indian culture,” Patel said.

For years, deo ads had followed the same script. It started in 2008 with the ad for Unilever’s Axe ‘Dark Temptation’ Body Spray campaign—a man literally made of chocolate, strutting around, sniffed and nibbled by women. The I&B Ministry pulled it from Indian screens for being too “vulgar,” but not before it made an impression, even in small-town India.

Anindya Vedant, a software engineer from Noida, was one of many taken in by the Axe hype as a teenager in Bhilai, Chhattisgarh.

“I was in Class 8 and bottle cost around Rs 150–200, which felt like too much back then. Owning it as a teen was a huge deal,” he recalled, adding that the actual effects were a “massive disappointment”.

While smelling like chocolate didn’t make anyone irresistible, Axe had created a cultural moment. Other brands—Wild Stone, Engage, Secret—jumped on the same bandwagon. But by the mid-2010s, the formula was wearing thin and brands started trying new spins. Nivea Men pivoted to promoting ‘confidence’ in its 2013 “It Starts With You” campaign and Fogg’s practicality proposition was driving sales.

But Patel wasn’t done yet. Fogg’s no-gas USP had worked, but he needed a bigger hook. In 2015, while visiting retail shops in Hyderabad, he stumbled upon it.

“I would ask retailers, ‘Deo mai kya chal raha hai?’ (Which deodorant is selling right now?), and every shopkeeper had the same answer—‘Fogg chal raha hai,’” he recalled.

If retailers knew Fogg chal raha hai, and I knew Fogg chal raha hai, then the audience should also know Fogg chal raha hai

-Darshan Patel

After hearing the same answer from about 10-12 shops, it was a lightbulb moment for Patel. He took the phrase straight to his advertising agency.

“If retailers knew Fogg chal raha hai, and I knew Fogg chal raha hai, then the audience should also know Fogg chal raha hai,” Patel said.

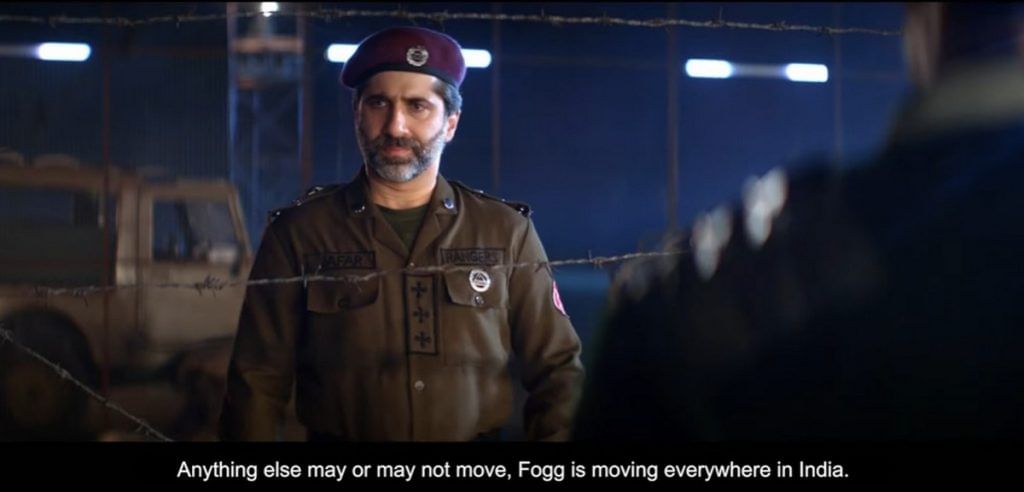

The campaign that followed turned a casual phrase into a cultural phenomenon. The ads took a simple, everyday question—kya chal raha?—and ran with it. Teenagers dodged nosy uncles with it. An Indian border guard lobbed it at his Pakistani counterpart. A 2023 sequel even reunited the guards, ending with: “Aur kuch chale na chale, India mein toh Fogg chal raha hai.”

“With Fogg, we tapped into the Indian sense of humour,” said Suyash Khabya, chief creative officer at The Womb, which created the campaign. “The audience was able to feel, ‘this brand is me.’”

The campaign, he added, avoided the classic deo ad trope of shaming customers— starting with someone feeling awkward or downright stinky, and then swooping in with a saviour product.

“We swear by one mantra: never put down your customer,” Khabya said.

The campaign’s relatability and wit turned ‘Fogg chal raha hai’ into a pop-culture catchline, helping the brand dominate the market.

“You’ve got to be the first to speak up—and do it in the most compelling way possible,” Khabya said. “Once you’ve made your mark, keep repeating that message consistently to carve out your position in the market.”

While Patel was initially concerned about others stealing his idea of a “no-gas” perfume spray, he said being the underdog helped.

“For the first 2-3 years, no one saw the potential in the idea. They thought it wouldn’t succeed, and that worked in my favour.”

Also Read: India funding world cricket. And it’s riding on paan masala, tractor, rebar, deo market

Fogg vs the fame game

Whether they foreground seduction, success, celebrities, or practicality, deodorant brands take cues from each other. Fogg skipped celebrity endorsements while rivals banked on Bollywood and cricket stars, but Patel was taking notes on other things.

“I learned from these big giants how to establish a strong distribution network,” he said, adding that one of his biggest challenges was ensuring that his products were available from Kashmir to Kanyakumari. “We are now present from a kirana store to a supermarket.”

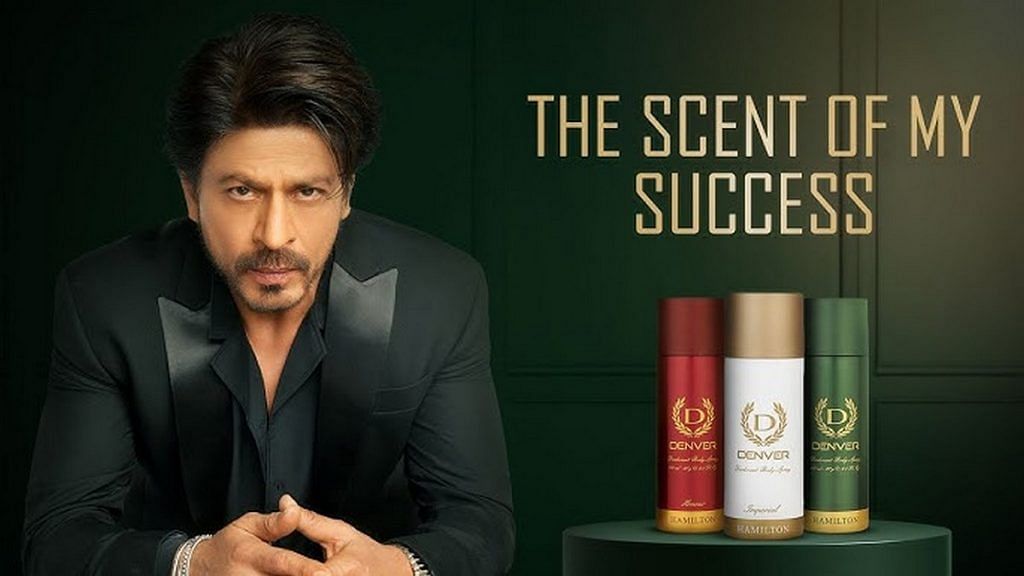

And even as brands leveraged star power—Shah Rukh Khan for Denver, Ranveer Singh for Set Wet, Virat Kohli for Cinthol, Ranbir Kapoor for Axe Signature—the messaging itself morphed. Success and striving replaced sex appeal.

Denver CEO Saurabh Gupta told ThePrint that this shift is exactly what sold Shah Rukh Khan on appearing in Denver’s ads.

“SRK said, ‘I love that you’ve positioned your brand as the ‘scent of success’ rather than a magnet for female attention. It’s brilliant,’” Gupta recounted.

Despite their different branding strategies, Gupta doesn’t shy away from tipping his hat to Patel.

“I’ve met him a couple of times, but he doesn’t know how much I’ve learned from his journey with Fogg,” he said.

Denver had launched in 2008 with the same ‘attraction’ playbook as Axe. But Naved Akhtar, Creative Agency Head at Design Shops, saw a change in how young consumers viewed fragrance.

“Deodorants, to them, were about creating an aura of confidence,” he said.

That insight led to Denver’s pivot toward a success-driven narrative, with Saif Ali Khan and later Shah Rukh Khan as the faces of the brand. Their latest campaign features SRK delivering the line: “Success shouldn’t get to your head but to your heart.”

A celebrity endorsement only works when there’s a real connection between the star and the brand, according to Akhtar.

“SRK’s journey from an outsider to a Bollywood icon is the embodiment of success, perfectly aligning with Denver’s ethos,” he said.

But he’s sceptical about celebrities launching their own brands—such as Salman Khan, who founded FRSH perfumes and deodorants in 2022 and Hrithik Roshan who launched HRX in 2013. He compared it to the US in the 1970s, when sporting legends Joe Namath and Muhammad Ali launched their own colognes—Broadway Joe and Champ. Both flopped despite their fame.

“Everyone with money seems to be starting a deodorant line or a restaurant but only a few are profitable; most end up in losses,” Akhtar said. “Consumer behaviour shifts rapidly. It’s survival of the fittest. Throwing money at a brand without understanding the market won’t cut it.”

With the glut of celebrities endorsing multiple brands at once, some consumers have started tuning them out, like 31-year-old homemaker Shruti Sadana. She said she first started buying Wipro’s Yardley deo because Katrina Kaif was the brand ambassador, but now she’s grown weary of celebrities.

“It’s ironic—they promote Indian products but probably stock their own shelves with Gucci and Valentino,” said Sadana. Like many younger consumers, she now turns to influencers like sisters Kritika and Deeksha Khurana for recommendations.

“If I’m spending Rs 300 on a deodorant, it’s purely for the fragrance and its staying power,” she said. “Nothing else matters.”

Fogg, meanwhile, has built its success across men’s, women’s, and unisex offerings without any A-listers. Indeed, during the 2019 Cricket World Cup, a spontaneous recall study found that Fogg’s ads outperformed all celebrity-endorsed brands, achieving a 72 per cent recall rate. It was the most recalled ad of the tournament.

Adman Khabya now advises companies to avoid the “trap of celebrities”, having seen Fogg’s trajectory.

A second innings

For Darshan Patel, selling the family business Paras Pharmaceuticals was never the plan.

“It’s painful. I never wanted to sell Paras, but my elder and younger brother were not inclined to work together after my father’s death in 1998,” he said. So, in 2006, he took a backseat and agreed to sell the company.

The multinational Reckitt Benckiser acquired Paras Pharma in December 2010 for Rs 3,260 crore—one of the biggest consumer goods acquisitions in India. And Patel found himself retired at just 44 and embraced a slower-paced life.

“I wanted to give back to nature, so I turned to farming and was enjoying the relaxed lifestyle,” he said.

However, that changed when a friend urged him not to waste his potential. The idea of starting afresh took hold. His daughter resisted at first, wanting him to focus on family, but in the end, he had their blessing.

In 2010, Patel launched Vini Cosmetics, starting with 18+ deodorants and Jinjola talc. It was in the course of market research for these brands that a bigger idea struck him—a deodorant with a non-aerosol pump. That idea would become Fogg.

The timing was just right, according to Patel. Between 2006 and 2011, the grooming market was undergoing tremendous growth. And from 2014 onwards, “with GDP growth, increased disposable income, and a young population”, this only accelerated.

“For men, wearing a good watch and smelling great are key ways to make a statement. Fragrance enhances their personality and is one of the most important accessories he can show off,” he said.

Denver’s Gupta also noted how attitudes to fragrance started changing around this period. Until the early 2000s, Indian men lagged in hygiene trends, but by 2009–2011, corporate culture and air-conditioned offices made body odour impossible to ignore. Yet, this wasn’t enough to get mass traction.

“Convincing men to use them wasn’t easy,” Gupta said. “Brands tapped into the aspirational angle—like promising female attention—to sell the idea.”

But Patel— who has always been clear that he’s more interested in product performance than trends—didn’t think that was necessary. And his instincts didn’t fail him. In 2014, Abhay Pandey, then managing director at Sequoia Capital, which invested Rs 110 crore in Vini for a nine per cent stake, called Patel “easily the best marketing brain in the country”.

Also Read: Naga mom’s K-skincare wave swept India. Her Beauty Barn now competes with Nykaa, Amazon

To deo or not to deo

In its early years, Fogg had only a handful of products, but now its lineup includes at least three dozen—from deos and mini perfumes priced around Rs 100 to scents like ‘Make My Day’ for women and ‘Xtremo’ for men, costing about Rs 600. And there’s more in the perfume pipeline.

Even after selling a majority stake in Vini Cosmetics to global investment giant KKR in 2021 for $625 million (Rs 4,600 crore), he hasn’t stepped away and is at the office every day. And it’s still a family business.

His son, 30-year-old Manan Patel, now handles the company’s finances. A finance and marketing graduate, he worked as a portfolio adviser before joining Vini and now accompanies his father to every meeting.

“My son handles my finances,” Patel joked. “My daughter spends it.”

There are still new launches to plan and segments to tap.

The deo market today thrives on 18- to 25-year-old consumers, according to independent market researcher Arvind Singhal.

“For students and young professionals who are always on the move or playing sports, deodorants are a budget-friendly everyday essential,” he said. However, Gen Z are also getting pickier about what exactly they spray on themselves, depending on the occasion.

Nineteen-year-old Prahlad Misra, a student at Jaypee Institute of Information Technology, never leaves home without a spritz of deodorant but reserves special fragrances for formal events like high tea.

“Deos are lighter, less concentrated, and perfect for casual wear,” he said, but “perfumes are an art form, a way to express yourself.”

Arushri Sadana, a senior consultant at a Bengaluru fintech firm, takes an even more deliberate approach, curating scents for every setting—Bela Vita for the office, Victoria’s Secret mists for weekends, Calvin Klein for nights out. When it’s a big date or party, she brings out the heavy hitters like Prada Paradoxe or Burberry.

“Fragrance can make or break a date,” said the 26-year-old firmly. “Men know this now. For me, it’s a deal breaker. If he doesn’t smell good, there’s no second date. Period.”

For today’s youth, every space they occupy reflects their personality. They want their surroundings to smell as unique and aesthetic as they do

-Saurabh Gupta, Denver CEO

But this divide—between deodorants as a daily staple and perfumes as a statement—is getting blurred. Brands like Denver have started offering the same fragrance in both deo and perfume form, catering to loyalists who want their signature scent in every format.

“Indian men are fiercely loyal when it comes to their brands,” added Gupta.

Gone are the days when fragrance just meant rose, sandalwood, or lavender. Consumers now crave bolder, more complex notes—whiskey, amber, and leather. Beardo’s Whisky Smoke deodorant, Maison Alhambra’s Amber & Leather, Denver Hamilton’s woody and spicy blends, and SKINN’s Forest Rouge with nutmeg, lemon, vanilla, and smoky accords are all catering to this demand.

“A whiskey-infused perfume screams confidence and edge, while oud’s strong notes leave a mark wherever you go,” said software engineer Vedant, who has stuck with Denver Hamilton—from the Rs 235 deo or the Rs 615 perfume—for the last six years after breaking up with Axe.

And deodorants aren’t just for personal fragrance anymore. Young consumers are increasingly using them as car sprays, bathroom mists, even room fresheners—a trend that Gupta claims will lead to “a boom like never before.”

“For today’s youth, every space they occupy reflects their personality,” he added. “They want their surroundings to smell as unique and aesthetic as they do.”

Patel, meanwhile, wants to do for perfume what he did for deos—put a fancy but well-priced bottle in every bathroom cabinet.

“We are working on launching a few new fragrances in the next few weeks—I want to introduce good quality perfume to the Indian masses,” he said.

(Edited by Asavari Singh)